The 2026 National Budget, themed “Enhancing Drivers of Economic Growth and Transformation Towards Vision 2030,” serves as the inaugural fiscal framework for the second five-year National Development Strategy (NDS2 2026–2030).

It aims to build on the gains of NDS1 while steering Zimbabwe towards its Vision 2030 goal of becoming an empowered and prosperous upper-middle-income society.

This analysis evaluates the budget’s positive strides and persistent challenges, linking them to the strategic pillars of NDS2 and the long-term Vision 2030.

Positives and Strategic Alignment

- Macroeconomic Stabilisation as the Foundation

The budget prioritises “anchoring macroeconomic stability” as its foremost objective, recognising the devastating impact of past inflation and currency instability. Significant progress is noted: annual ZiG inflation fell from 85.7% in April 2025 to 32.7% in October 2025, with a target of single digits in 2026.

Exchange rate stability has been achieved since September 2024, with the parallel market premium narrowing from 36% to 20%. This stability is attributed to prudent fiscal and tight monetary policy coordination—a critical prerequisite for investment, savings, and financial sector deepening under NDS2 Pillar 1: Macroeconomic Stability and Financial Sector Deepening.

- Growth Projections and Sectoral Drivers

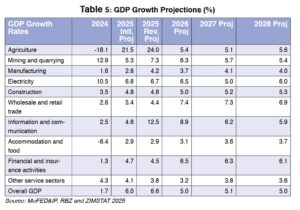

The budget projects a real GDP growth of 5.0% in 2026, following an estimated 6.6% in 2025. Key growth drivers are agriculture (recovering from drought), mining, and manufacturing. The mining sector, in particular, is expected to be the largest contributor to GDP growth in 2026.

This aligns with NDS2 Pillar 2: Inclusive Economic Growth and Structural Transformation, emphasising value addition in mining and agriculture. The budget supports this through specific allocations for mineral beneficiation and the cotton-to-clothing value chain.

- Infrastructure Development as an Economic Catalyst

A total of ZiG26.9 billion is allocated to infrastructure in 2026, focusing on transport, energy, water, and digital infrastructure. Major road projects like the Harare–Beitbridge and Bulawayo–Victoria Falls highways are near completion, enhancing regional connectivity and trade corridors.

This directly supports NDS2 Pillar 3: Infrastructure Development and Housing and is vital for improving Zimbabwe’s competitiveness, a key aspect of Vision 2030.

- Social Protection and Human Capital Investment

The budget allocates significant resources to social services, education, and health, which together constitute about 50% of the budget. ZiG47.4 billion is set aside for Primary and Secondary Education, and ZiG30.4 billion for Health.

Programmes like the Basic Education Assistance Module (BEAM) and the Zimbabwe Social Cash Transfers aim to protect the vulnerable. These efforts align with NDS2 Pillar 7: Social Development, Gender and Social Protection and are essential for building the human capital required for a prosperous society under Vision 2030.

- Financial Sector Deepening and Inclusion

The budget notes that the banking sector is well-capitalised and non-performing loans are low at 2.9%. It also promotes financial inclusion through the National Financial Inclusion Strategy, with data showing increased lending to women, youth, and MSMEs.

The planned Zimbabwe Entrepreneurship Exchange (ZEEX) will provide an alternative trading platform for SMEs to raise capital. These initiatives support NDS2 Pillar 1 and aim to mobilise long-term savings for development.

Challenges and Risks

- Fiscal Constraints and High Wage Bill

Despite revenue growth, the fiscal space remains limited. MDAs submitted bids totalling ZiG828.5 billion, but only ZiG253 billion is available. A major concern is the high public wage bill, which consumes 53% of revenue in 2026, above the desired 50% target. This crowds out productive investment and poses a risk to macroeconomic stability if not contained.

- High Public Debt and Arrears

The stock of Public and Publicly Guaranteed debt stands at US$23.4 billion (44.7% of GDP) as of September 2025, with external debt arrears at US$7.7 billion. Domestic expenditure arrears to service providers are estimated at US$1.7 billion, undermining budget credibility and private sector operations. The budget outlines a five-year arrears clearance plan, but this remains a significant fiscal risk.

- Transition to Mono-Currency Risks

The budget reaffirms the long-term goal of transitioning to a ZiG mono-currency to restore monetary policy effectiveness. However, it outlines stringent pre-conditions, including durable single-digit inflation, adequate forex reserves (3–6 months import cover), and financial sector stability. Given current reserves of just over one month of import cover, this transition remains a distant and risky prospect.

Alignment with NDS2 and Vision 2030

The 2026 Budget is clearly structured around the ten pillars of NDS2, with allocations mapped to each priority area. Its emphasis on macroeconomic stability, infrastructure, value addition, and human capital development is consistent with the Vision 2030 aspiration of an upper-middle-income society.

Positively, the budget demonstrates a credible commitment to fiscal discipline, stability, and strategic investment in growth-enabling infrastructure. It also shows a pro-poor orientation through expanded social protection.

However, significant headwinds remain: a high debt burden, vulnerability to climate and commodity shocks, a constraining wage bill, and structural informality. The success of the budget—and by extension NDS2 and Vision 2030—will depend on:

– Strict adherence to fiscal discipline and arrears clearance.

– Effective implementation of value-addition policies to reduce external vulnerability.

– Mobilising private investment, especially in energy and infrastructure.

– Containing the wage bill while improving public service efficiency.

However, the 2026 Budget provides a realistic, if challenging, roadmap for the first year of NDS2. Its success hinges on rigorous implementation, continued policy coherence, and resilience to external shocks—all necessary to keep Zimbabwe on the path to Vision 2030.